Financial Algebra and its Importance in Education

Imagine a world where students not only excel in math but also gain essential skills to manage their finances wisely. This is the vision behind the NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications. In today’s fast-paced society, understanding financial concepts is crucial for success. The modern economy demands more than just traditional algebra; it requires knowledge that empowers students to make informed financial decisions.

This curriculum aims to bridge that gap by combining mathematical principles with real-world financial scenarios. It equips learners with tools they need to navigate everything from budgeting and saving to investments and loans. Embracing this educational approach can transform how students perceive math—turning complex equations into practical solutions that impact their daily lives. Let’s delve deeper into what makes this curriculum a game changer in education and beyond!

Understanding the NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications

The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications offers a structured approach to teaching crucial financial concepts. This curriculum blends traditional algebraic principles with real-world financial scenarios, making math relevant and engaging.

Students explore topics like budgeting, interest rates, and investments. They learn how to analyze data through spreadsheets and graphing techniques. These skills are essential in today’s economy.

This curriculum emphasizes problem-solving and critical thinking. Students not only compute numbers but also interpret their meanings within various contexts.

By integrating financial literacy into the math classroom, New Jersey aims to equip students with tools that foster lifelong financial responsibility. The focus is on preparing them for future endeavors—whether it be higher education or personal finance management.

Benefits of Incorporating Financial Algebra in Education

Incorporating Financial Algebra into education equips students with essential skills for life. It goes beyond traditional math, focusing on real-world financial scenarios.

Students learn to analyze budgets, understand interest rates, and make informed investment choices. These concepts help demystify personal finance, promoting smarter money management.

Moreover, the curriculum enhances critical thinking abilities. Students face practical problems and develop solutions through algebraic reasoning. This skill is invaluable in any field they pursue.

Engagement levels rise as learners connect mathematical principles to everyday decisions. The subject fosters a sense of responsibility towards finances that extends well into adulthood.

These lessons cultivate future-ready individuals who can navigate complex financial landscapes confidently and effectively.

Real-life Applications of Financial Algebra

Financial algebra bridges the gap between theoretical math and everyday life. It equips students with tools to make informed financial decisions.

Imagine calculating interest rates for a loan or determining monthly payments on a mortgage. Financial algebra makes these concepts accessible.

Students learn to analyze stock market trends, helping them understand investments and risk management. This knowledge fosters confidence in their ability to grow wealth over time.

Budgeting is another practical skill gained through this curriculum. Learning how to allocate resources effectively prepares students for real-world challenges like saving for college or planning vacations.

Understanding taxes, insurance, and other financial obligations also becomes clearer. These lessons empower young adults as they transition into independence, ensuring they are better prepared for future endeavors.

Success Stories of Students Who Have Taken the Course

Many students have found their passion and purpose through the NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications. One such student, Maria, learned how to manage her finances effectively. She created a budget plan that helped her save for college.

Then there’s Jake, who discovered his knack for investments in this course. He successfully simulated stock trading and gained insights into market trends that sparked his interest in finance as a career path.

Ava used the skills she acquired to help her family navigate financial challenges during tough times. Her ability to analyze loans and savings options made a significant difference for them.

Stories like these highlight the transformative power of financial algebra education. Students not only gain mathematical skills but also develop essential life skills that empower them long after they leave the classroom.

Tips for Teachers on Implementing the Curriculum Effectively

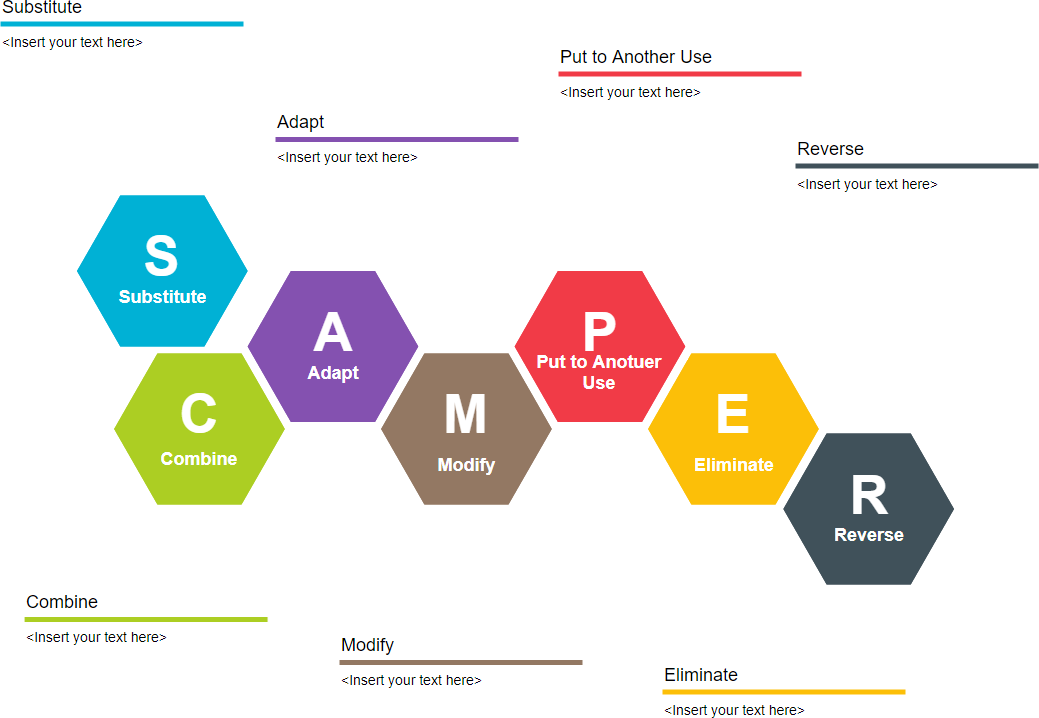

Teachers can enhance the experience of the NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications by creating interactive lessons. Use real-world scenarios to illustrate concepts, making them relatable and engaging.

Incorporate technology into your teaching methods. Utilize financial apps or online simulations to provide hands-on learning opportunities. This approach allows students to visualize abstract ideas more clearly.

Encourage collaborative projects where students work in groups. Teamwork fosters communication skills and helps learners share different perspectives on financial issues.

Regular assessments are vital but keep them varied—quizzes, presentations, and practical applications can highlight student understanding from multiple angles.

Invite guest speakers from finance-related fields to share their experiences. Real-world insights make the subject matter come alive and demonstrate its relevance in everyday life.

Master Your Finances with NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications

Understanding personal finance is crucial. The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications equips students with essential skills. This curriculum dives deep into topics like budgeting, saving, and investing.

Students learn how to analyze financial data effectively. They engage in real-world problem-solving scenarios that apply mathematical concepts to everyday situations. From calculating interest rates to understanding loan agreements, these lessons make math relevant and practical.

By mastering these financial principles, students can take control of their economic future. They’ll be better prepared for college expenses or managing a first paycheck. Knowledge gained through this course instills confidence in making informed financial decisions.

The interactive nature of the curriculum encourages collaboration among peers while developing critical thinking skills. It’s not just about numbers; it’s about building a foundation for lifelong financial literacy and independence.

Transform Your Future: NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications

Financial literacy is no longer a luxury but a necessity. The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications paves the way for students to grasp essential financial concepts early on.

Imagine understanding how credit works or learning to budget effectively while still in high school. This curriculum transforms abstract math into practical skills that can be used daily.

Students dive into real-world scenarios, applying algebraic principles to personal finance situations like managing investments and calculating interest rates.

This hands-on approach empowers learners not just academically but also financially. They emerge equipped to make informed decisions about their money, laying the groundwork for future success.

With engaging lessons and relevant applications, this program inspires confidence in navigating financial landscapes. It’s more than just math; it’s about building a foundation for lifelong fiscal responsibility.

Essential Guide: NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications

The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications serves as a vital resource for educators and students alike. It intertwines mathematical concepts with real-world financial scenarios, making learning relevant and engaging.

This curriculum goes beyond traditional algebra by integrating topics like budgeting, investing, and loan management. Students learn to apply math in practical situations, fostering critical thinking skills that are essential for their future.

Teachers will find valuable tools within this curriculum to guide their instruction. Lesson plans are designed to promote interactive learning experiences while meeting state standards.

Furthermore, the course emphasizes collaboration among students. Group projects encourage teamwork while addressing complex financial problems together. This not only enhances understanding but also builds communication skills crucial in today’s economy.

With its focus on applicable knowledge, the NJ Curriculum sets the stage for informed decision-making in personal finance later in life.

Empower Your Learning: NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications

Empowering students begins with relevant education. The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications does just that. It connects mathematical concepts to real-world financial scenarios.

Imagine mastering skills like budgeting or understanding interest rates while developing algebraic proficiency. This curriculum ensures that learners are not only solving equations but also making informed financial decisions.

Interactive projects and practical exercises stimulate engagement, fostering a deeper grasp of both math and finance. Students learn to analyze data critically, preparing them for future challenges in their personal and professional lives.

The curriculum emphasizes collaboration among peers too. Group activities encourage dialogue about financial literacy, enhancing social learning experiences.

By marrying mathematics with essential life skills, the NJ Curriculum equips learners to face the complexities of adulthood confidently. Engaging lessons make the subject matter relatable, ensuring knowledge retention and application beyond the classroom walls.

Empowering the Next Generation with Financial Literacy Through Financial Algebra

The NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications plays a pivotal role in shaping financially savvy individuals. By integrating real-world financial concepts into the learning process, students gain essential skills that equip them to navigate their financial futures confidently.

As we move forward, it is crucial to recognize that financial literacy extends beyond simple budgeting or understanding credit scores. It encompasses a broad range of topics, including investments, loans, and managing expenses effectively. The curriculum encourages critical thinking and problem-solving skills through practical applications of algebraic concepts in everyday life situations.

Students who engage with this curriculum are not just learning math; they are preparing themselves for significant life decisions. They develop an awareness of how to manage money wisely—a skill set that serves them well throughout their lives. From selecting the right college financing options to understanding mortgage agreements later on, these lessons have lasting impacts.

For teachers and educators involved in this subject matter, there lies an exciting opportunity: fostering an environment where students can explore these ideas freely and creatively. Real-life examples can spark interest among learners while making complex topics accessible and relatable.

Through collaboration between schools, families, and communities focused on enhancing educational outcomes related to financial literacy, we create a robust foundation for future generations. Together we can ensure young people are equipped not only academically but also practically as they step into adulthood prepared for success in all aspects of their lives—financially included.

By championing programs like the NJ Curriculum for Financial Algebra Advanced Algebra with Financial Applications now more than ever before—and providing targeted support—we enable our youth to thrive today and tomorrow.